People Are Paying Millions For Land in the Metaverse. Here's Why

This story is part of Making the Metaverse, CNET's exploration of the next stage in the internet's evolution.

Tasteful, Japanese-themed furnishings. A view of the city. Elevator access. After Clerkclirk saw the penthouse apartment, he quickly decided to pull the trigger. And because he liked the neighborhood so much, he bought another 70 properties there.

In total, Clerkclirk dropped $92,000 on the condos. But the 31-year-old Indonesian speculator isn't a real estate magnate, and none of the condos qualify as real estate, despite their desirable locations. The units are digital plots in Worldwide Webb Land's metaverse, a virtual world stored on servers.

"You can't say 'no' to profit," said Clerkclirk, who said he planned to sell his properties when the price rose. Like many traders in the metaverse, Clerkclirk declined to give his legal name.

Startling amounts of money are being spent on virtual real estate inside Worldwide Webb Land and other metaverses. In June, a metaverse investment firm called Republic Realm spent $913,000 on a parcel in Decentraland, another metaverse. It was the largest deal of its kind at the time. About six months later, the same firm bought 792 plots in Sandbox, still another metaverse, from video game company Atari for an eye-watering $4.23 million.

The idea of the metaverse goes back decades. Second Life, a virtual gathering place that started in the aughts, is one of the oldest. Fortnite, a video game with a building component, is a newer, more sophisticated example, as are Roblox and Minecraft. At its most basic, a metaverse is a shared, persistent digital space for meetings, games and socializing. Some observers see a future in which many metaverses interconnect, though others envision a variety of independent digital realms with their gates drawn.

CEO Mark Zuckerberg reignited and spread interest in the concept when he rebranded Facebook as Meta, a nod to the Silicon Valley giant's ambitions to make its mark in the metaverse the way it did in social media. It's been a topic of discussion at trend-setting conferences, like last week's SXSW festival and this week's Game Developers Conference.

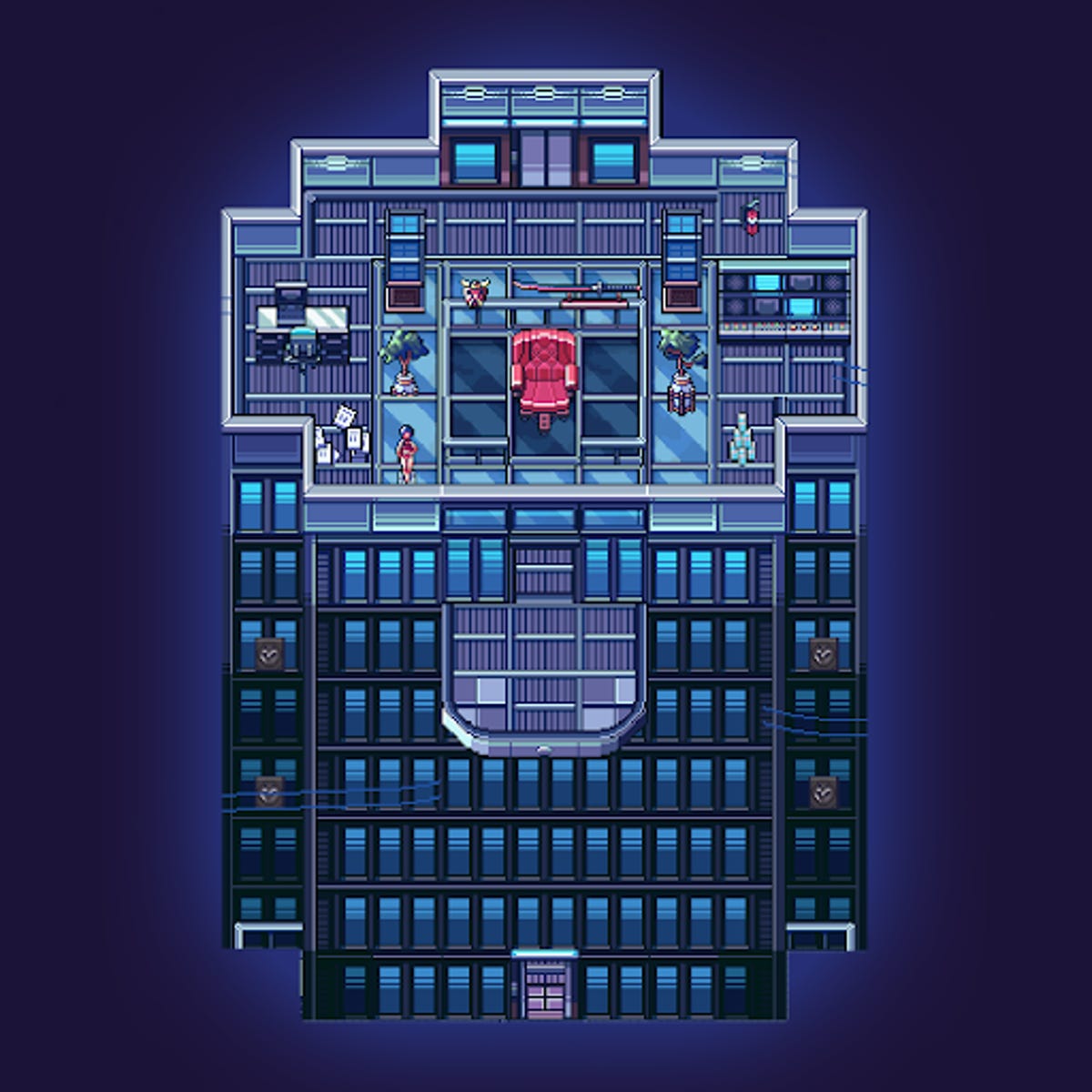

A penthouse in Worldwide Webb Land.

Worldwide Webb LandIn recent years, the growth of blockchain ledgers has helped birth new metaverses that make it easy for people like Clerkclirk to buy parts of them. The digital property deeds, or non-fungible tokens (NFTs), that represent ownership are recorded on blockchains, allowing them to be sold again in the future.

The two leading metaverses are Decentraland, which started in 2017, and Sandbox, which flickered onto the internet two years later. New virtual lands are being created almost every month. Worldwide Webb Land, where Clerkclirk bought his penthouse, is four months old.

"What sets us apart is our interoperability and accessibility," a spokesperson for Worldwide Webb Land said. The interoperability refers to the metaverse's integration with over 300,000 NFTs -- if you own one of the supported NFTs, you can use it as an in-world avatar. Worldwide Webb Land's 2D graphics also mean it can be played smoothly on most computers and phones. When asked if the project's land sales are driven by speculation, the spokesperson said that "there are too many factors driving the market to point just one out." Decentraland did not respond to a request for comment.

Clerkclirk was early to blockchain-integrated metaverses. After buying $500 in bitcoin in 2017, he chanced upon $Mana, another cryptocurrency. He soon discovered $Mana was the currency of Decentraland, which promised to be the first virtual world owned by its users. Decentraland is made up of 90,000 parcels, which are recorded on the Ethereum blockchain as NFTs.

This story is part of CNET's exploration of the internet's next iteration.

Naomi AntoninoTo Clerkclirk, Decentraland represented a supply-demand imbalance. The number of parcels is fixed, but he reckoned that newbies adopting cryptocurrencies would plow in, pushing up the price of both bitcoin and plots in Decentraland. He was right.

In three months, his initial $500 investment in bitcoin grew to be worth roughly $20,000. Clerkclirk continues to periodically invest in metaverse real estate -- his Worldwide Webb Land penthouse, for example -- even though he's skeptical about what you can do in a virtual world.

"Are people actually going to spend the majority of their time in the metaverse?" he asks.

Metaverse expansion

Some investors are banking on it.

In November, Metaverse Group, a virtual real estate firm located in the real-life city of Toronto, splashed out $2.5 million on 116 blocks of virtual land in Decentraland's fashion district.

Andrew Kiguel, CEO of Tokens.com, which owns 50% of Metaverse Group, thinks he got a bargain. His reasoning is similar to Clerclirk's. If more people get excited about the metaverse, the value of parcels in Decentraland will rise because the metaverse will do what social media does: deliver advertising.

Decentraland currently has 800,000 users, up from just 40,000 at the beginning of 2021. It's a safe bet, Kiguel reckons, that the growth rate will continue to rise, at least for a while. That means new and veteran Decentralanders will pass by his company's prime virtual real estate every day when they spend time in the digital realm. Just like social media platforms, it will provide an opportunity to get advertisements in front of eyeballs.

"On Facebook or Instagram, every fifth scroll or so you're served an ad," Kiguel told me over Zoom. "We're doing something similar but at an earlier stage. We're pre-purchasing advertising space."

Decentraland is a metaverse similar to Second Life. It's simulation of the real world, where people can meet and socialize.

DecentralandBeginning Thursday, Decentraland and Tokens.com will host Metaverse Fashion Week, a fashion festival modeled after Fashion Week in New York and London. Brands like Dolce and Gabanna, Hugo Boss and Tommy Hilfiger will take part. It'll run for three days, through Sunday, during which time Kiguel expects 500,000 users will frequent the virtual festivities.

Kiguel's plan is a case study in turning virtual property into a revenue-generating investment. Though the fashion fest will take place inside Decentraland, landlords like Metaverse Group will be paid for the use of their spaces. After-parties are expected in nearby neighborhoods, giving property owners an opportunity to charge for entry. Property owners can also sell digital billboard space, which brands can bid on as they would in the real world.

Each metaverse has its own way to allure users. Decentraland operates like a simulator, where you create an avatar and socialize with others in simulacrums of real-life environments. Sandbox leans into gamification. Influenced by Minecraft, Sandbox gives people extensive tools for crafting items, building homes and even creating games. Unlike Decentraland, Sandbox isn't accessible to the general public yet. A closed beta took place in October. An open beta is expected soon. The marketplace for virtual property, like a yacht that sold for $650,000, is already open to all.

In both Decentraland and Sandbox, prices are booming because of the promise that virtual land can be used to attract valuable attention, either now or in the future.

"What makes Sandbox land valuable is not the fact that they're blocky pieces of land," said Yat Siu, co-founder of Animoca Brands, which owns Sandbox. "It's the fact that the most influential people in the space are building on it."

That includes brands, like Adidas and Atari, as well as celebrities such as Paris Hilton and Snoop Dogg. Snoop Dogg is in particularly deep, owning a Sandbox mansion where he performs and hosts parties. A celebrity moving in is good for prices: a plot of land next to Snoop Dogg's mansion went for $458,000.

Influenced by Minecraft, Sandbox leans more toward gaming.

SandboxFunction and speculation

True believers are adamant that the promise of the metaverse will be realized. But the current velocity of transactions suggests much of the interest in virtual property may be unsustainable. The abundance of short-term activity makes it difficult to determine the long-term commitment to these worlds.

Consider Clerkclirk. He was driven to buy property in Worldwide Webb Land because the team behind it launched with a working product and planned to follow up with games that take place in the virtual world. But as prices climbed, the future work wasn't enough to entice him to hold on to the penthouse.

He bought it on a Wednesday for $36,000 and sold it two days later for $126,000.

Source

Tags:

- People Are Paying Millions For Land In The Metaverse Here S Lucy Tv Series

- People Are Paying Millions For Land In The Metaverse Here S Your Perfect Chords

- People Are Paying Millions For Land Investing

- People Are Paying Millions For Prisoners

- What People Are Paying For Vehicles

- People Are Crazy Billy Currington

- People Are People Lyrics

- How Many People Are On Earth

Blog Archive

-

▼

2022

(176)

-

▼

December

(57)

- Is Anxiety Ruining Your Sleep? 5 Tips To Relieve A...

- HBO Max's Raised By Wolves Combines Ridley Scott S...

- Microsoft Surface Laptop Go 2 Review: The Tricky M...

- WhatsApp Goes Down For Many Across Globe

- Apple MacBook Air (2018) Review: The New MacBook A...

- Anker Nebula Cosmos Laser 4K Projector Review: Get...

- Twitter Rolls Out A Way To Showcase Your NFTs

- At CES 2022, AMD Hit All The Gaming Targets

- You Can Finally Use Snapchat On Your Computer, But...

- Google Offering Pixel 4 XL Extended Repair Program

- Snapchat Warns Apple's Privacy Changes Could Hurt ...

- Google ChromeOS Flex Is Now Ready To Run Your Old ...

- How Much Cheaper Are Store-Brand Groceries Than Na...

- Save Big On Discounted Asus Desktop PCs, Laptops A...

- Apple's Rumored IPhone 14 Max Could Be The Giant I...

- Google: Bye-Bye, Bidets. Employees: Not So Fast.

- Google's Pixel 6 Phones Are Coming With A Chip Des...

- People Are Paying Millions For Land In The Metaver...

- Lil Nas X Headlines TikTok's New Collection Of NFTs

- TikTok May Have A Music App In The Works

- Tesla Now Has A Supercharger In Every US State Wit...

- The Bob's Burgers Movie Review: The Belchers Sizzl...

- Motorola's Back-to-School Sale Knocks Up To $600 O...

- Snapchat's Augmented Reality Lenses Can Span Whole...

- Black Adam Teaser Trailer Reveals The Rock In God ...

- Move Your Toddler Into A Big Kid Bed With These 5 ...

- Samsung To Overhaul Smartwatch With Galaxy Watch 4...

- All 8 Harry Potter Movies Are Coming Back To Peaco...

- Nvidia AI Tech Lets Computers Understand The 3D Wo...

- Disney Streams Fireworks To Celebrate Being Halfwa...

- Facebook-owned WhatsApp Launches New WhatsApp Busi...

- Best Places To Buy Specialty Foods Online

- Hit The Ground Running With 50% Off The Garmin Ven...

- Asus ZenBook 13 (2020) Review: This Small Laptop M...

- How To Win The New York Times Spelling Bee Every S...

- 'Oh No, Our Table, It's Broken' On TikTok: What It...

- The Best Ways To Make Awesome Coffee On The Cheap

- Mortgage Forbearance And Eviction Extensions Run T...

- Best Antivirus Software For 2022

- Living EV-Only With Our Long-Term Mini Cooper SE A...

- Doctors Call On Spotify To Stop COVID Misinformati...

- Samsung Galaxy Z Fold 3: Can The Upgrades Win Over...

- SolarWinds Hackers Accessed DHS Acting Secretary's...

- Honda And Sony Team Up To Build And Sell Electric ...

- Facebook Portal Plus Review: A Decent Video-chat D...

- Pokemon Go PokeStops Are Coming To Best Buy And Ga...

- Strengthen Your Heart Health With These Workouts

- Forest Bathing: The Free Cure For Stress And Anxiety?

- Earth Day 2022: 10 CNET Stories About The State Of...

- Computer Company Framework Wants You To Upgrade An...

- Pokemon Scarlet And Violet Teasing Another New Pok...

- Google Considered Using Drones For Firefighting

- Intel Warns That Price Hikes Are Coming This Year

- Apple Watch SE: If You've Been Holding Out On Buyi...

- Motorola's Edge Plus Puts A 60MP Selfie Camera Up ...

- The 563-HP M760e Is BMW M's First Plug-In Hybrid

- 'Stranger Things' Logo Lights Up As Halloween Costume

-

▼

December

(57)

Total Pageviews

Search This Blog

Popular Posts

-

Underwriting for mortgage takes how long how long underwriting takes how long is underwriting for home loan how long for underwriting mortga...

-

Lenovo smart clock gen 2 amazon lenovo smart clock generation 2 smart clock 2 lenovo lenovo gen 2 smart clock lenovo clock gen 2 lenovo smar...

-

Halo tv show paramount plus release paramount halo tv series halo paramount show episodes halo series paramount plus halo tv show on paramou...